Small Payday Loans Online with No Credit Check - Low Credit Finance Overview

Explore Customizable Online Payday Loan Options for Bad Credit Borrowers via Low Credit Finance

New York, June 28, 2025 (GLOBE NEWSWIRE) --

Factors such as bad credit, little to no credit history, unemployment, and low income can create barriers between you and an urgently needed loan, ultimately denying you the chance to access the necessary funds.

To address these challenges, we have compiled a list of the top small payday loans online no credit check lenders. These lenders do not conduct credit checks, making it seamless to obtain the funds you require to meet your unexpected financial obligations.

If you are seeking a small payday loan online with no credit check, please continue reading for our recommended lenders.

Best Small Payday Loans Online Lenders

- Low Credit Finance – For customizable small payday loans.

You can easily get a small payday loan online from any of these lenders at your convenience. Want to learn more about them? Keep reading for a review of each.

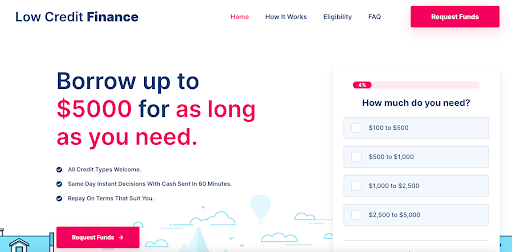

- Low Credit Finance: For customizable small payday loans

With instant decisions and repayment terms that can be customized to your liking, Low Credit Finance is the best small payday loan online lender with no credit checks. The flexible repayment terms allow you to borrow amounts of up to $5,000 for as long as you need.

Its security protocols and low APR make it a viable go-to small payday loan online no credit check lender for many borrowers with bad credit scores.

Below are some other benefits of choosing Low Credit Finance as your small payday loan lender:

- Hassle-free online application.

- Flexible repayment terms.

- Negotiable loan policies.

- High approval rates.

- All credit types are feasible for lending.

- Quick funding.

Low Credit Finance offers borrowers with bad credit a great opportunity to access small payday loans online no credit checks at their convenience.

What Is a Small Payday Loan?

A small payday loan is a short-term loan that is offered to individuals who need quick access to cash to cover unexpected expenses or financial emergencies. These loans are usually intended to be repaid often on the borrower's next payday. However, with the flexibility of some of the lenders’ repayment terms, they could be repaid within a few weeks or months.

Small payday loans are unsecured as borrowers do not need to provide any collateral to secure the loan. Instead, the following are the requirements to meet for one to be qualified for a small payday loan:

- The minimum age requirement is 18 years or older.

- Be a citizen of the United States or have permanent resident status.

- Have a verifiable and stable source of income.

- Maintain a healthy debt-to-income ratio.

- Possess a valid and active bank account.

- Provide a valid email address and phone number for communication purposes.

While small payday loans are a convenient way to access some much-needed quick cash, they often come with high fees and interest rates, making them a potentially expensive form of borrowing.

How to Apply for an Online Small Payday Loan

The application process for an online small payday loan is easy and convenient. The following are the steps to follow to get your much-needed loan today:

- Select a payday lending company of your choice from our list of recommended providers.

- Visit the lender's official website.

- Complete a brief and straightforward application form.

- Submit your application and await an approval decision from the lender.

- Upon approval, the loan amount will be transferred to your bank account.

By following the above steps, you are guaranteed a small payday loan from any of our recommended lenders.

Who can access a Small Payday Loans?

Many people turn to small payday loans as a way to access quick cash in an emergency or to cover unexpected expenses. Here, we will discuss some of the most common payday loan borrowers. They are:

Individuals with bad credit

People with bad credit can use small payday loans because they are usually unable to qualify for traditional forms of credit, such as credit cards or personal loans. With a poor credit history, this group is usually seen as a higher risk by lenders, making it harder for them to access credit or to secure favorable terms. Payday loans may be seen as a way to access cash quickly as they have no credit checks.

Low-income earners

Individuals with low incomes are often the most frequent users of payday loans because they struggle to make ends meet and may not have access to other forms of credit. With limited savings and a low credit score, they find it challenging to borrow from traditional lenders. Small payday loans offer a quick and convenient way to access cash for this lot.

Young adults

Young adults between the ages of 18 and 24 are more likely to use small payday loans than any other age group. This is due to limited credit history and income, as most of them are still in the early years of their careers and may not have established credit or savings. Lack of access to other sources of funding is also another reason why young adults turn to small payday loans.

Minorities

Minority communities can also utilize payday loans due to limited access to traditional forms of credit and systemic economic disparities. It is for this reason that small payday loan providers tend to be more prevalent in neighborhoods with high minority populations.

Freelancers

Freelancers, or better yet, gig economy workers, often have unpredictable income streams that make it challenging to qualify for traditional loans. Small payday loans can provide a quick and easy source of cash for these individuals to cover unexpected expenses or manage their cash flow. Lenders typically do not require collateral, and they have no credit checks, making them a more accessible option.

Impact of Small Payday Loans On Consumers

Positive Impacts

- Access to emergency funds - Small payday loans provide consumers with access to quick cash in case of an emergency. Unlike traditional loans, payday loans often have a quick and straightforward application process, which helps consumers access the funds they need more quickly.

- Improved credit score - If the borrower repays the loan on time, small payday loans can help improve their credit score by showing a history of timely payments. This can be particularly beneficial for borrowers who have limited credit history or poor credit scores. By demonstrating that they can manage their debts, borrowers can build a positive credit history and potentially qualify for better loan terms in the future.

- Avoiding greater financial problems - Small payday loans help consumers avoid more significant financial problems, such as defaulting on a loan or having their utilities shut off. Taking out a payday loan helps borrowers avoid late fees and penalties for other obligations that could further exacerbate their financial situation.

Negative impacts:

- High-interest rates and fees – Small payday loans often come with interest rates and fees that are relatively higher compared to conventional loans. This can cause borrowers to fall into a debt cycle and struggle to repay the loan.

- Predatory lending practices – Some small payday loan lenders engage in predatory practices, such as aggressive marketing, hiding fees, targeting low-income or minority communities, and even encouraging borrowers to take out multiple loans at once, which can make it even harder to repay the debt.

- Debt cycle – As small payday loans are designed to be repaid within a short period, there is a chance that some consumers may find it difficult to repay the loan within that period and end up taking out another loan to cover the first one. This can lead to a debt cycle that can be difficult to break.

Conclusion

In conclusion, small payday loans can be a double-edged sword. They offer quick financial relief to those in need but also create a cycle of debt that is difficult to escape. While they can be a solution for immediate financial needs, borrowers ought to be cautious and considerate of the long-term implications of taking out a small payday loan. They should also be aware of their financial situation and ensure that they can repay the loan on time.

Overall, the decision to take out a small payday loan should be made carefully, weighing the pros and cons and exploring all options before committing. Financial stability should be the ultimate goal, and small payday loans should only be considered a last resort.

Frequently Asked Questions

How long does it take to get approved for a small payday loan?

The approval process for a small payday loan can vary depending on the lender, but most lenders provide instant approval and can deposit the loan funds directly into your bank account within 24 hours or even less. You must, however, make the application during working hours to ensure no delays.

What happens if I can't pay back my small payday loan on time?

If you can't pay back your small payday loan on time, the lender may charge additional fees and interest, and the outstanding balance will continue to accrue interest until it is paid in full.

Can I get a small payday loan if I have bad credit?

Yes, you can still qualify for a small payday loan even if you have bad credit. Most payday lenders do not require a credit check; instead, they focus on your ability to repay the loan.

Can I get more than one small payday loan at a time?

While it is possible to have multiple small payday loans at the same time, it is generally not recommended as it can lead to a debt cycle and further financial difficulties.

Are small payday loans regulated by the government?

Yes, small payday loans are regulated by state and federal laws, including caps on interest rates and maximum loan amounts.

Are small payday loans a good idea?

Small payday loans can be a good option in certain situations when you need money quickly and have no other alternatives. However, they should be used sparingly and only for emergency expenses.

What should I do if I am having trouble paying back my small payday loan?

If you are having trouble paying back your small payday loan, you should contact your lender immediately to discuss your options. Some lenders may be willing to work out a payment plan or offer an extended repayment period.

- Email Support: support@lowcreditfinance.com

- Phone Number: 1-844-870-5672

Disclaimer and Disclosure

This article is intended for informational purposes only and does not constitute financial, legal, or professional advice. Readers are strongly encouraged to conduct their own independent research and consult a qualified financial advisor before making any financial decisions. The content herein reflects general information that may not be applicable to all individuals or jurisdictions.

Neither the publisher of this article nor its syndication partners assume any responsibility or liability for any inaccuracies, typographical errors, outdated information, or omissions that may be present in this content. Although every effort has been made to ensure the accuracy of the information at the time of publication, no guarantees are made regarding its completeness or reliability. Any actions taken by the reader based on the content of this article are strictly at their own risk.

The publisher and its affiliates do not endorse any specific lender, financial product, or service mentioned in this content. Any product or brand references are provided solely for educational and illustrative purposes.

This article may contain affiliate links. This means the publisher may receive compensation if readers click on a link or make a purchase through an affiliate partner. Such compensation does not influence the editorial content, which remains independent and unbiased. The presence of affiliate links does not constitute an endorsement of any product, service, or provider.

By reading this content, the reader agrees to hold the publisher, its writers, editors, and all affiliated syndication platforms harmless from any and all liability, damages, or claims arising directly or indirectly from the use of any information presented herein.

Email Support: support@lowcreditfinance.com Phone Number: 1-844-870-5672

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.